The Account Bar is a list of the accounts you've added to Quicken.

Click an account name in the Account Bar on the left side menu to open its register.Click the Account Actions icon at top right for a menu of tasks, preferences, and reports related to the account you are working with.Click the tabs to access tools and features organized around common financial activities.Click the icon to open the Account List, where you can edit your account names and make other changes.

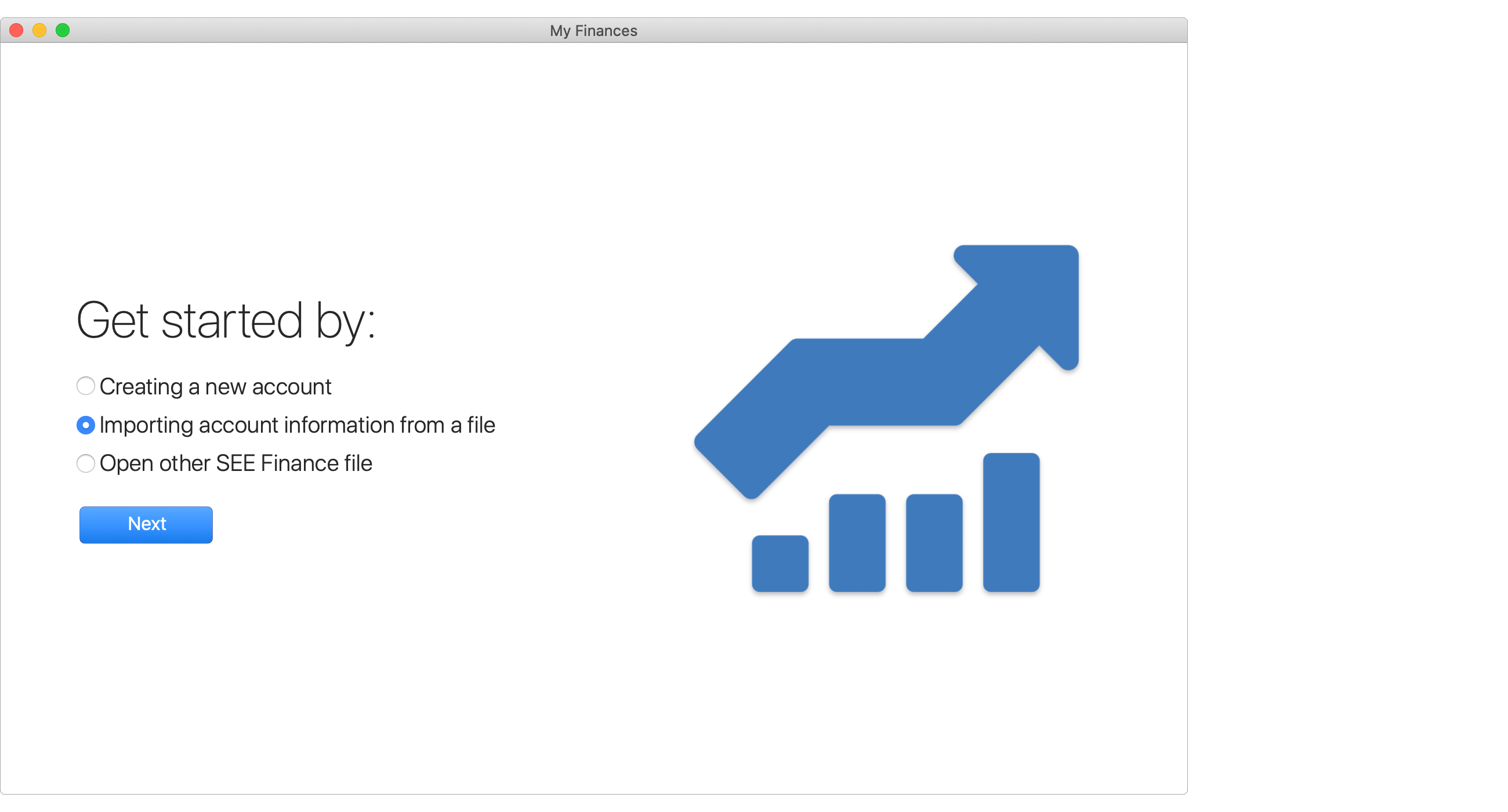

#CASH FLOW REPORT IN QUICKEN FOR MAC DOWNLOAD#

#CASH FLOW REPORT IN QUICKEN FOR MAC HOW TO#

Just follow along and we’ll show you how add your spending accounts, create reminders for your bills and income, and use the Projected Balances graph.Īfterwards, if you decide that you want to learn more about tracking your cash flow in Quicken, we’ll show you how to categorize your transactions, check your cash flow using a pie chart and a report, and where to find other great cash flow features in Quicken. Using it you can see when you’ll have money, when you won’t, and when you might need to think of creative ways to “smooth the graph out” so you don’t end up underwater before your next paycheck. The Projected Balances graph displays a forward-looking estimate of the total amount of money in your spending accounts, plotted against time. Here’s the Projected Balances graph, one of the tools you’ll learn about in this guide: Wow! This can help you avoid late fees and overdraft charges, and perhaps put some of that “extra money” you might find into your savings account. How does Quicken help with cash flow? It’s pretty simple: just tell Quicken which accounts you spend from, what your bills are, and when you expect income it can then remind you when your bills are due, and project your spending account balances into the future. Do you have a have a general idea of where you stand financially? Accompanied by a sinking feeling you’re spending more than you’re taking in? Quicken can help! By understanding how much money comes in and where it all goes-in other words, your cash flow-you can plan realistically and avoid the paycheck-to-paycheck struggle to make ends meet.

0 kommentar(er)

0 kommentar(er)